Here are 2019’s top 18 offshore drilling companies on the global stage:

For the latest global offshore drilling market report, oil drilling market forecast, and top offshore drilling companies profiles, please see Global Offshore Drilling Market Report 2018-2022, or request your free report sample now!

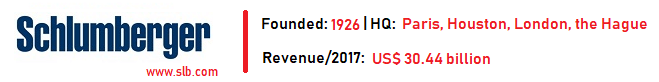

Schlumberger is currently topping the list of the world’s top offshore drilling companies. It is the biggest offshore drilling contractor (in terms of revenue) not just in the US but across the world has a history of science and technology innovation, backed by strategic mergers and acquisitions. From conventional to application-specific systems for geothermal wells, rigs, jack-ups, unconventional plays and more, Schlumberger’s drilling services are designed to trim down the installation time and enhance safety.

Schlumberger supplies the industry’s most comprehensive range of products and services, from exploration through production and integrated pore-to-pipeline solutions for hydrocarbon recovery that optimize reservoir performance.

Corporate Highlights:

- Designated the world’s largest oilfield services company.

- Schlumberger employs a staggering 100,000 people, representing 140 nationalities across 85 countries.

- This offshore drilling giant is placed 287 in the ‘Fortune Global 500’ list (2016).

- Schlumberger posted a Q1, 2018 revenue of US$ 7.829 billion.

- As part of Newsweek’s ‘Green Rankings’, Schlumberger was ranked 118th out of 500 large eco-conscious companies. In its own speciality, the company is the 3rd ranked offshore driller out of 31 entries.

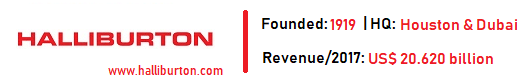

Halliburton serves the upstream oil and gas sector throughout the lifecycle of the reservoir, from locating reserves and managing geological data, to drilling evaluation, well construction, completion and production optimization through the life of the field. Offshore drilling services offered by Halliburton include horizontal and directional drilling, measurement-while-drilling, logging-while-drilling, multilateral systems, underbalanced applications and rig site information systems.

Corporate Highlights:

- Halliburton is one of the largest oilfield service companies on the planet. It employs 50,000 people and operates across 70 countries.

- The company posted a Q1,2018 revenue of US$ 5.74 billion.

- Halliburton’s core business speciality is the Energy Services Group (ESG).

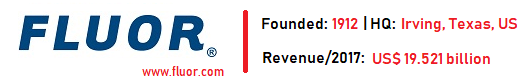

Fluor Corporation is a MNC engineering and construction firm, the largest such entity in the ‘Fortune 500’ rankings, with a listing of 149. The company specializes in engineering, procurement, and construction management services for drilling and production resources at offshore fields and other energy assets. Fluor was involved in the development of some major offshore areas such as the Enfield oil field in Australia, Nasr/Al-Nasr field development in Abu Dhabi, UAE, the Ku-Maloob-Zaap field in Mexico, and the Bohai Bay field in China.

Corporate Highlights:

- Fluor posted a Q1,2018 revenue of US$ 4.8 billion.

- The company is a leading manufacturer of pollution control products, including the Econamine lineup of carbon capture products.

Baker Hughes specializes in drilling, production, and completion services for oil, gas and other energy industries. Offshore drilling systems offered by Baker Hughes include directional drilling services, measurement-while-drilling, coiled tubing and re-entry, logging-while-drilling, casing/liner drilling systems, drilling optimization, and remote drilling. Who Dat field in the Gulf of Mexico and the Skuld offshore field in the Norwegian Sea are some of the major offshore oil fields wherein the company offers its deep-water drilling services.

Corporate Highlights:

- As of July 2017, General Electric Company (GE) owns 62.5% of Baker Hughes, affording it the majority share.

- Baker Hughes posted Q1,2018 revenue of US$ 5.4 billion.

Transocean Ltd. is the world’s largest provider of offshore contract drilling services across the globe. With 140 mobile offshore drilling units, four ultra-deepwater new build units, and five high-specification jack-ups, the company’s fleet is considered one of the most versatile and modern in the world owing to its significant emphasis on technically demanding sections of the offshore drilling business.

Corporate Highlights:

- In May, 2017, Transocean commanded a market capitalization of $4.9 billion.

- The company has offices in 20 countries.

- Transocean is sitting atop a record backlog of about US$12.4 billion as of May, 2018.

- The company recently acquired Cyprus based Songa Offshore for a record US$ 1.1 billion.

- 84% of the company’s fleet is dedicated to Ultra Deep Water (UDW) & HE Floaters. Transocean doesn’t own any shallow-water assets.

The company’s operations are geographically dispersed in terms of oil and gas exploration. As its drilling rigs are mobile assets that can be moved according to prevailing market conditions, the company operates comfortably in a single market scenario as well as internationally. More recently, Transocean has shown great resolve in dealing with the oil crash and the industry’s general lethargy and is poised to have a dominant 2018.

To see more detailed offshore drilling companies analysis, download your Global Offshore Drilling Market Sample for FREE

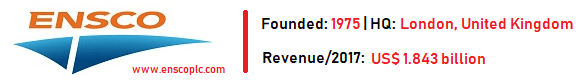

For more than 25 years, UK-based Ensco Plc has been bringing energy to the world as an international provider of offshore drilling services in the oil and petroleum industry. Ensco has a significant presence in the most strategic offshore basins across six continents. On Oct 6, 2017, Ensco acquired the Houston-based offshore driller Atwood Oceanics in an all-stock deal. The company has made timely acquisitions to grow into a dominating offshore drilling company, and the acquisition of Atwood has incremented the organization’s brand value.

Corporate Highlights:

- Ensco Plc is currently credited as the second largest offshore drilling company based on capacity.

- The company owns and operates 38 offshore jackup rigs, 15 semi-automatic platform drilling rigs and 12 drillships.

- Ensco posted a Q1, 2018 revenue of US$ 417 million.

- Three of Ensco’s jackup rigs are currently employed in the Middle East as part of very lucrative three-year contracts.

In 2017, things were a bit uncertain for the Bermuda-based offshore drilling company Seadrill. The company used a Chapter 11 bankruptcy filing to get its balance sheet in order. Bankruptcy risk for Seadrill grew considering a crushing industry downturn and billions of dollars in debt that had to be serviced. However, the company has the most capable, newest fleets of drilling vessels in operation and a strong track record of efficient and safe procedures that make it an ideal partner for several oil producers.

Corporate Highlights:

- Seadrill posted a Q2,2017 revenue of US$ 577 million.

- As of the end of 2017, the company posted a backlog of approx. US$ 3.1 billion.

- Seadrill filed for bankruptcy protection in Sep, 2017.

- A key player in the petroleum industry, Seadrill’s recent surge is thanks to the spike in oil prices.

Post declaration of bankruptcy, Seadrill sports a strong balance sheet. The investors are thinking smartly and keeping Seadrill on their radar, to engage once again after the company emerges from bankruptcy completely sometime in 2018. If things go right for Seadrill, 2018 is poised to be an excellent year.

Noble Corporation, one of the leading offshore drilling companies for the oil and gas sector, has had an incredibly difficult time along with its competitors since the start of the oil crash, but has made many noticeable improvements in recent times. The company owns and operates one of the most versatile, modern, and technically advanced fleets in the offshore drilling industry.

Corporate Highlights:

- The Noble Corporation commanded market capitalization worth US$ 1.436 billion as of May, 2018.

- A top offshore drilling contractor, Noble owns 28 top-notch rigs. However, half of these are currently unemployed.

- Low near term debts grant this company some serious staying power.

- Noble posted a Q1, 2018 revenue of US$ 235.2 million. This is the company’s lowest ever intake for any quarter, ever.

- Noble’s offshore fleet spells versatility. This affords the company the best vantage point, of all the other big drillers, to fight for and win contracts. This is strategy one for Noble in 2018.

The US based public limited company operates a fleet of 28 offshore drilling units, comprising of 14 drillships and six semisubmersibles along with 14 jack-ups. These machinery are focused squarely on ultra-deepwater and high-specification jack-up drilling jobs, applicable across both emerging and established regions worldwide.

Diamond Offshore Drilling incorporated on April 12, 1989 and traces its foundation to the earliest days of the offshore drilling sector. Today, the company operates in the waters of six continents, supplying comprehensive drilling services to the global energy industry. Configured to attain the optimum balance of performance and flexibility, Diamond Offshore’s fleet has amassed its reputation on more than four decades of real-world drilling experience. The company’s diverse fleet includes 14 jack-ups, 30 semisubmersibles, and one dynamically positioned drillship.

Corporate Highlights:

- ODECO, Diamond Offshore’s predecessor, designed the world’s first submersible drilling rig.

- Over 58% of the company’s revenues are generated via operations outside of the US.

- Diamond posted a Q1,2018 revenue of US$ 295.51 million.

- The company’s fleet lacks diversification and is aging fast. From 2014-2017, Diamond retired or sold 12 rigs to recover over US$ 1.0 billion.

Read more: Top 5 Companies in the Global Advanced Energy Market

Rowan is one of the best-positioned companies in the offshore drilling industry in terms of both tackling weather weaknesses and taking advantage of the improved industry conditions. The company has the only UDW fleet in the industry composed of all seventh-generation rigs, which delivers extra performance and safety features as requested by customers. The company is financially powerful and has adequate cash to handle its commitments until 2023.

Corporate Highlights:

- Rowan’s fleet comprises of 23 offshore drilling jackup rigs and 4 UDW drillships. An additional 5 jackup rigs are also listed as part of its JV with Saudi Aramco.

- Rowan Companies posted a Q1,2018 revenue of US$ 211.2 million.

- The majority of the company’s 2017 revenue was generated from the following partnerships: 29% : Saudi Aramco, 17% : Anadarko Petroleum, 14% : Cobalt International Energy, 7% : Repsol and ConocoPhillips.

For detailed information about the global offshore drilling market size, offshore oil and gas industry statistics, and top offshore drilling companies, take a look at Technavio’s Global Offshore Drilling Market Report Sample for FREE!

Saipem, an Italy-based company, has been operating as one of the world’s leading offshore drilling companies since its inception in 1969. The company provides onshore and offshore drilling services while encompassing nearly all types of rig and geographical areas. Following the acquisition of a surge of engineering companies, most prominently, Bouygues Offshore, Sofresid and Snamprogetti, Saipem has become one of the leading engineering and construction companies.

Saipem, an Italy-based company, has been operating as one of the world’s leading offshore drilling companies since its inception in 1969. The company provides onshore and offshore drilling services while encompassing nearly all types of rig and geographical areas. Following the acquisition of a surge of engineering companies, most prominently, Bouygues Offshore, Sofresid and Snamprogetti, Saipem has become one of the leading engineering and construction companies.

The company operates both in deep waters and shallow, using hi-tech drilling fleet including the ultra-deepwater DP drillships Saipem 12000 and Saipem 10000 and the fifth-generation semi-submersible drilling units Scarabeo 7 and Scarabeo 5.

Corporate Highlights:

- Saipem is based in over 60 countries.

- The company posted a backlog of €11,500 million, as of Q1 2018.

- Saipem 7000 is the world’s second largest crane vessel, after the Thialf.

Weatherford International, domiciled in Switzerland and operationally based in Houston is one of the leading offshore drilling companies and suppliers of a wide range of equipment and services for the oil and gas drilling industry, operating in nearly 100 countries. Their drilling business is on its way to becoming a standalone independent drilling contractor. Today, the company operates with a fleet of 115 rigs and 6000+ people. By and large, it is a new breed service company that provides the industry more efficient operations, extended products and services and greater geographic diversity.

Corporate Highlights:

- Weatherford is listed in the ‘Euronext Vigeo World 120 index’, an exclusive categorization comprising of 120 of the most advanced companies in the European, North American and APAC regions.

- Weatherford was pursuing a groundbreaking OneStim JV with Schlumberger that would have elevated the company’s game considerably. However, as of Jan-2018, this JV has been scrapped.

- Currently, Weatherford’s shares are trading at an eight year low. However, these shares have massive gain potential, thus, the company is a favorite at the stock markets.

With many successful refurbishments and new building projects, the Aberdeen, Scotland-based Stena Drilling has been a pioneer in many areas of technological innovation and developments in the offshore drilling companies list. The company operates globally with three midwater drilling rigs and four ultra deepwater drillships. Stena Drilling has been successful in obtaining commercial contracts for a majority of its fleet at attractive rates, thereby securing a prime source of cash flow.

Corporate Highlights:

- The company’s ‘Stena IceMAX’ is the world’s first dynamically positioned, dual mast, ice-class drillship.

- Stena Drilling’s parent company, Stena Sphere, has been profitable each year since 1939.

- In 2018, Stena Drilling secured a highly lucrative contract to work the giant Samo prospect, located off the coast of Gambia, Africa. This offshore project is expected to churn out 825 million barrels of oil annually.

Read more: How to Optimize Energy Management Strategies

With nearly five decades of experience in offshore drilling operations, China Oilfield Services Limited (COSL), one of the largest offshore drilling companies in China, is a versatile offshore oilfield service solution provider with sought-after integrated functions and bundled service chain in China and other countries worldwide. The company works in the four major business segments including drilling services, marine, transportation services, geophysical services and well services, covering the exploration, production and development phase of the oil and gas industry.

Corporate Highlights:

- COSL has a listed sister company based in Hong Kong named CNOOC Limited. The latter is a dominant offshore oil producer.

- The company’s main source of revenue comes from its operations in Indonesia, West Africa and the Middle East.

- COSL commands 95% share of China’s market for offshore drilling services.

Nabors Industries, is the largest land drilling company in the US and one of the top international land drilling contractors, with a fleet of more than 200 land drilling rigs operating in significant oil, gas, and geothermal drilling markets worldwide. The company is also grabbing substantial market share in offshore drilling services through dozens of its offshore, barge and jack-up rigs as well as a wide range of complementary oilfield engineering, management, and logistics services, making it one of the leading offshore drilling companies in the world.

Corporate Highlights:

- In 2017, Nabors acquired Tesco Corporation in an all-stocks deal.

- The company operates in 25 countries across the world, including India, Congo and Yemen.

- Nabors is listed on the S&P 500 and is recognized as the largest ‘land based’ driller in the world with a fleet of 500 rigs.

- As a supplier of offshore platform workover and drilling rigs, Nabors is highly commended for its jack-up and platform rigs, both of which are nestled on the bleeding edge of innovation.

The offshore fleet of the Norwegian company Fred. Olsen Energy with subsidiaries consists of five mid-water semi-submersible drilling rigs and two ultra-deepwater units. Three of its semi-submersible drilling rigs are operating on the Norwegian Continental Shelf. The company’s shipyard, Harland & Wolff, in Northern Ireland, focuses on steel fabrication, ship repair, and engineering services, alongside services for activities associated with offshore wind farms.

Corporate Highlights:

- Main shareholders of the company are ‘Bonheur’ and ‘Ganger Rolf ASA.’ Both of these companies are controlled by the Olsen family.

- Fred Olsen Energy’s enterprise value as of December 2017 was 12.6 billion Norwegian Kroner / US$ 1.9 billion.

- The company’s deep sea rigs are gainfully employed, commanding over US$ 500,000/day in some cases.

Read more: The Top 10 Global Wind Turbine Companies

KCA Deutag is among the largest offshore drilling companies in the UK. It is a world’s leading provider of drilling and engineering expertise and operates both onshore and offshore. A reliable brand name, KCA Deutag has won several new contracts in recent times. With 125 years of experience, the company is well poised to dominate the global offshore drilling industry. The group consists of four business segments: design and engineering, oilfield equipment manufacturing, land rig and offshore drilling. KCA Deutag operates roughly 90 drilling rigs in more than 20 countries.

Corporate Highlights:

- KCA Deutag operates in over 20 countries and employs a workforce of 9,000+ employees.

- The company is the result of the merger between KCA Drilling and Deutag AG in 2001.

- KCA Deutag operates an inland fleet of 61 rigs and offshore fleet comprising of 39 platforms.

Parker Drilling is one of the largest offshore drilling companies in the world, and it is an expert in advanced drilling solutions and is a key entity in the global energy industry. Operational across the world, Parker Drilling specializes in complex offshore-onshore drilling projects, rental tools and project management. The latter includes specialized options such as rig design and construction, alongside the management of its operations.

Corporate Highlights:

- Parker’s international fleet includes 21 land rigs and one offshore barge rig.

- The company’s US fleet includes 13 offshore barge rigs and two land rigs that are currently operational in Alaska.

- Parker Drilling holds a number of world records pertaining to deep sea and extended-reach drilling.

- In 2013, the company was cited with the title of “Drilling Contractor of the Year” by Exxon Neftegas, Ltd.

Other top offshore drilling companies in India, China, the USA, or other regions can be found in Technavio’s Global Offshore Drilling Market Report 2018-2022. Click HERE to get a market snapshot for FREE!